Message from the CEO

Balance, and the importance of achieving it, is something that resonates with me personally, not just as a CEO, but as a person navigating the complexities of life and business. At Corbion, we embrace the challenge of harmonizing our commitments to people, planet, and profit in a world in flux.

Today's global marketplace is highly complex and ever-changing. Geopolitical tensions, persistently high inflation, climate change, resource scarcity, pervasive technologies, and consumer behaviors are just some of the major influencing factors that continually reshape the business landscape and makes our work more difficult. But they also guide our priorities and decisions and create opportunities that fuel our growth as a company.

In 2023, as supply chain disruptions eased, manufacturers scaled back their orders due to declining retail volumes and the high inventories they had maintained as a safeguard against supply chain risks. Although the ongoing destocking trend among customers gradually subsided through the year, its impact varied across our customer base, making the already complex task of demand forecasting more difficult.

In Sustainable Food Solutions, the early part of 2023 brought declines in volume/mix attributed to customer destocking and a relatively subdued end-consumer market. Later in the year, the volume/mix trend saw gradual improvement. Input costs shifted, most decreasing in price, and only sugar — representing roughly one-quarter of our material inputs — became more expensive, due to El Niño-related production shortfalls in South and Southeast Asia, as well as port bottlenecks in Brazil. Even as supply chains improved, customers insisted on reducing material inventories, which impacted sales. In response to consumers’ heightened awareness of inflation, there was a notable shift away from premium products towards more economical alternatives, leading to a reduction in overall spending on food and beverages. As part of our response to this trend, we helped our customers minimize recipe costs, while replacing synthetic ingredients in favor of more natural alternatives.

We continued growing into a number of product/market adjacencies, such as dairy stabilizers, antioxidants, and natural mold inhibitors. Extensions to our Origin™ portfolio of natural antioxidants provided manufacturers with preservative benefits based on wild rosemary and acerola cherry extracts in lieu of fossil-based ingredients. We further expanded geographically with new agreements that broaden our distribution partnerships in Malaysia and Singapore and fortify our presence in the Asia–Pacific region. Most recently, we grew our capacity for manufacturing increasingly important vinegar-based solutions by bringing a new production facility online in Montgomery, Alabama (US) that will reduce supply risks and offer cost structure improvements.

In 2023, we evaluated competing offers to divest our non-core Emulsifier business. In January 2024, Corbion and Kingswood Capital Management announced an agreement in the divestiture of the business. The sale, anticipated in the second quarter of 2024, will allow Corbion to sharpen our focus on fermentation-based technologies.

It was a year of highs and lows for our Lactic Acid & Specialties business unit. On the challenging side, softness in the market for PLA persisted due to lockdowns in China, regulatory hurdles in the EU, continuing high inflation, and pressures on packaging and specialty plastics manufacturers to choose lower-cost materials. There were, however, signs of recovery in the third quarter with no further erosion since that time. We felt the effects of declining demand in the electronics segment, and high inventory levels in multiple industries led to customer destocking and headwinds for other areas of the business unit as well.

In agrochemicals, where we help create more sustainable crop protection products, high inventories and unfavorable weather conditions in 2023 slowed our sales. In the pharmaceutical industry, we saw temporarily decreased demand due to high stock levels accumulated through the pandemic and associated supply chain disruption. While we anticipate improved dynamics ahead in each of these segments, circumstances negatively impacted our results in 2023.

Results were much better in home and personal care, particularly in hygiene and cleaning products, where PURAC® Sanilac solutions provide a safe, effective, and natural means of protecting against the coronavirus and other microorganisms. Interest in this product line has remained high since the onset of the pandemic.

The real bright spot in Lactic Acid & Specialties was our Biomaterials business, which had a very strong year, as elective orthopedic surgeries picked up again after COVID-19. With a growing number of orthopedics and controlled drug delivery development projects in the pipeline, demand for our bioresorbable polymers remained robust. In the spring, the US Food and Drug Administration (FDA) approved a new extended-release drug treatment for schizophrenia we helped make possible, along with our joint venture partner MedinCell, for Teva Pharmaceuticals.

We finished the year by announcing the on-schedule mechanical completion of a first-of-its-kind circular lactic acid manufacturing plant at our site in Rayong, Thailand. This new facility will have the lowest associated carbon footprint and will be more cost effective compared to other manufacturing technologies, eliminates gypsum as a by-product, and fortifies Corbion's position as the global lactic acid market leader. We are also proud to report that the 2.5-year construction project, which has involved more than 2,000 contractors simultaneously onsite, achieved more than five million working hours without a single lost-time incident.

The Algae Ingredients business stood out as another area of strength for us. After achieving EBITDA breakeven in 2022, our algae business grew significantly while further increasing production yields, thus enabling it to contribute substantially to our EBITDA in 2023. Demand for our products in the aquaculture industry remained strong, as we gained more traction helping salmon producers with a sustainable alternative to fish oil, which grows more costly for producers as ocean temperatures rise, fishing seasons grow shorter, and fish populations decrease. We also expanded our portfolio with new high-margin, algae-based products that enhance the value proposition in both human and animal nutrition markets.

We wrote an important chapter in our sustainability story last year. Exemplifying transparency, we publicly shared Corbion’s detailed Climate Transition Action Plan and implemented measures to reduce both energy use and emissions at our plant in Gorinchem, the Netherlands. Published in 2023, CDP ranked Corbion in the top 8% of companies on the CDP Supplier Engagement Leaderboard, we were selected for a target validation pilot for reducing pressures on nature by the Science Based Targets Network, and EcoVadis awarded us with a Gold rating in 2024.

Corbion made excellent progress in our safety journey, achieving a global reduction of over 25% in total recordable injuries worldwide compared to 2022. This significant improvement reflects a profound shift in mindset. Several facilities truly stood out with best-in-class safety practices and performance, and we are working to transfer key learnings across the organization. Furthermore, we made substantial investments in process safety and expanded our Behavior-Based Safety Program launched in 2022 to additional sites worldwide.

In today's fast-paced global market, adaptability is key. The challenges of 2023 prompted us to reflect on our decisions and make necessary adjustments. As a result, we developed a restructuring program for implementation in 2024 to drive positive free cash flows based on material improvements in operating expenses, in our capital program, and in our working capital positions. Through this transformation, we aim to streamline operations and enhance efficiency to support our envisioned growth.

Corbion’s purpose will not change, nor will our commitment to it, but our approach to achieving it will evolve as needed to effectively balance our priorities and to align with the ever-shifting landscape around us. Our ability to effectively preserve what matters to our customers, suppliers, partners, shareholders, employees, and their families will continue to be our highest priority.

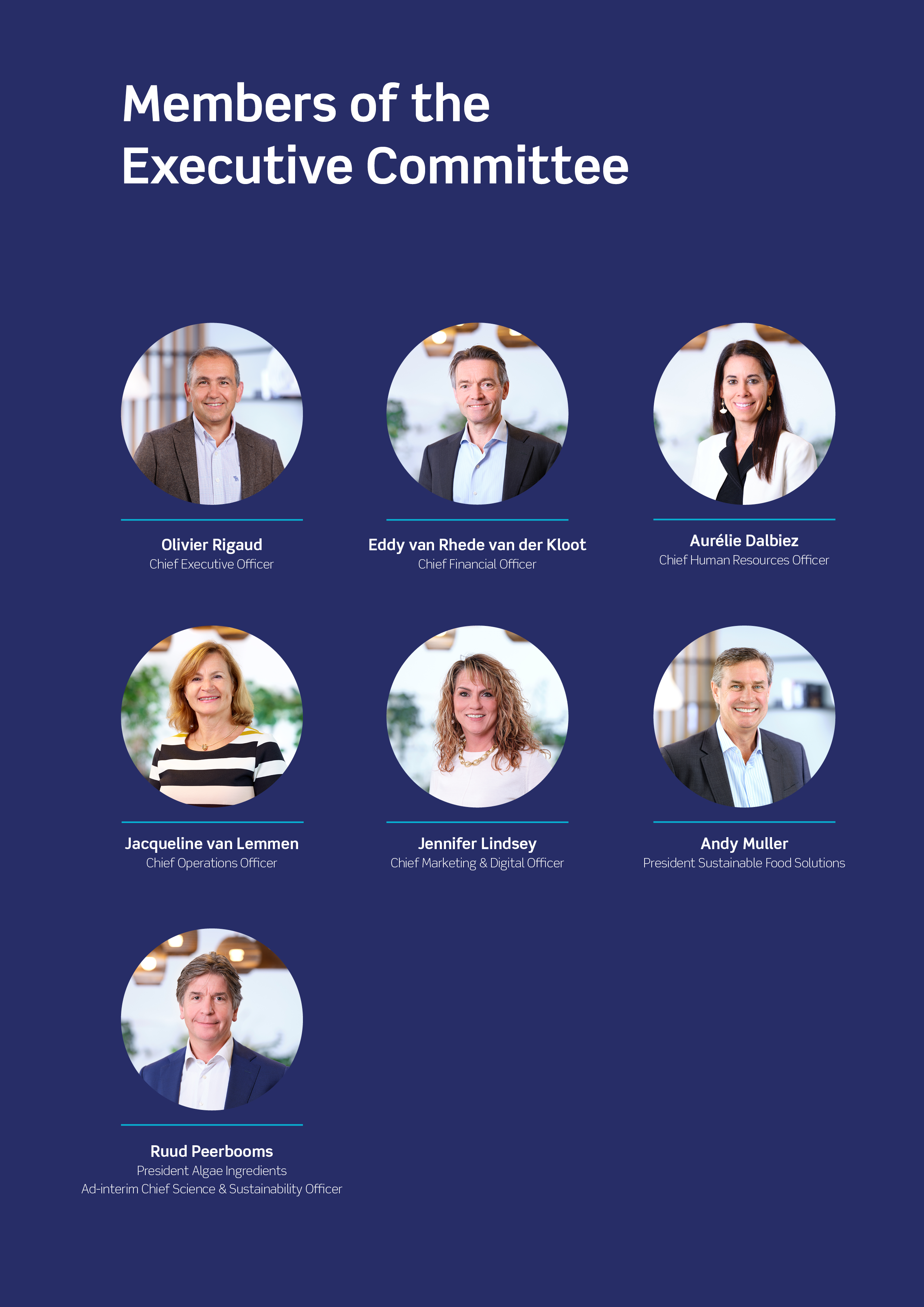

On behalf of the Executive Committee, thank you for supporting Corbion and our purpose-driven work to create sustainable business success.

Olivier Rigaud