Our strategy: Advance 2025

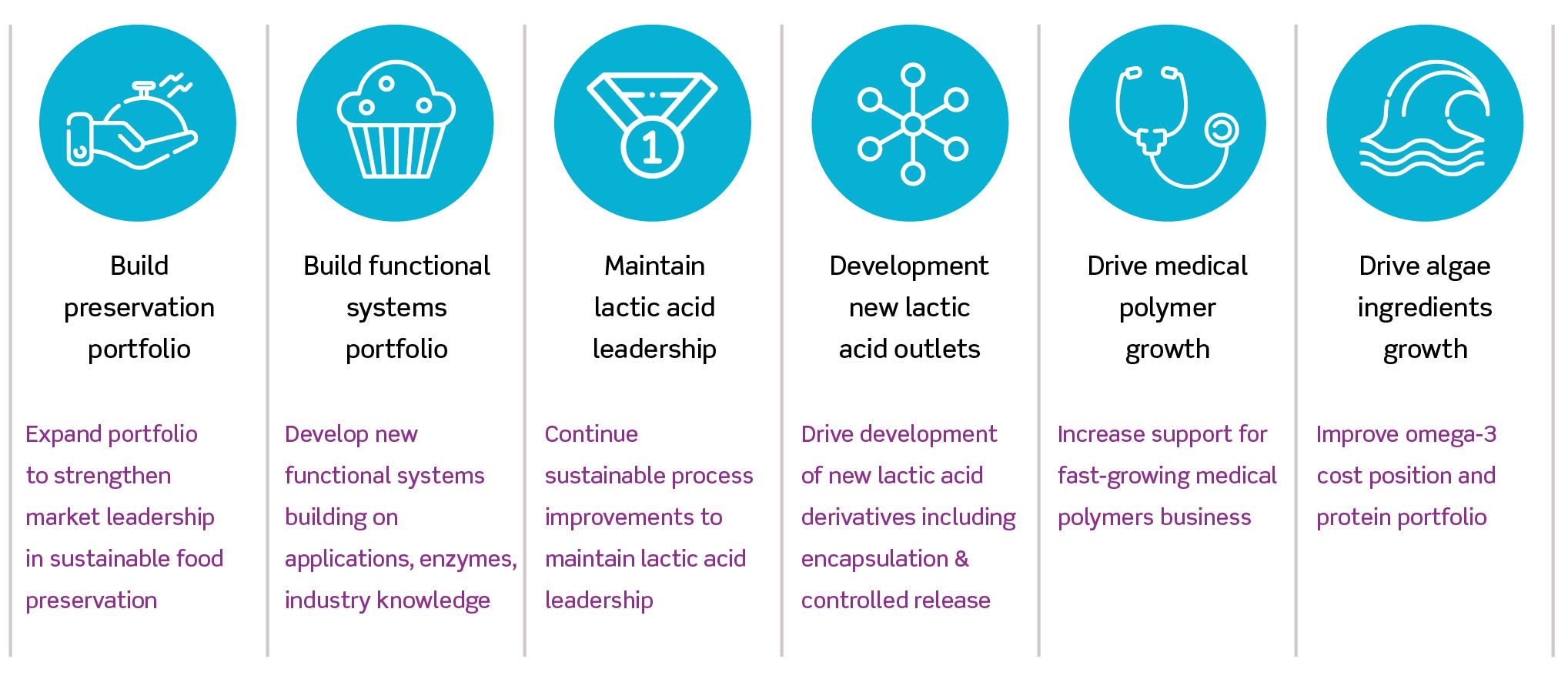

Our Advance 2025 strategy builds on Corbion’s fundamental strengths by further focusing our business portfolio in alignment with global market trends. This will be achieved by increased investments in key growth areas such as natural food preservation, algae-based ingredients, lactic acid derivatives, and natural polymers. Aligned with our purpose, "to preserve what matters," sustainability is at the heart of everything we do. Our commitment to delivering value for customers also addresses the pressing global need for more sustainable products and solutions. We have aligned our Advance 2025 strategy with the United Nations Sustainable Development Goals, specifically SDG 2 (Zero hunger), SDG 3 (Good health and well-being), and SDG 12 (Responsible consumption and production). These are the goals where we believe we can create the most significant impact, given our footprint, the nature of our business, and the environment in which we operate.

Our business and reporting structure now comprises four lines of business.

Sustainable Food Solutions

Sustainable Food Solutions comprises three segments: Preservation Solutions, Functional Systems, and Single Ingredients.

In Preservation Solutions, we leverage core competencies in fermentation and formulation by bringing a broad range of superior natural preservation and shelf-life extension solutions to food manufacturers in the bakery, meat, dairy, savory, and plant-based segments. We continue to grow our already unmatched portfolio, which includes lactic acid, lactates, natural mold inhibitors, natural ferments, vinegar, and natural antioxidants, while further expanding geographically in Europe and Southeast Asia. We deliver added value to our customers through dedicated technical service teams and by providing formulation calculators and predictive modeling tools that increase their speed to market. Recent additions include the industry’s first predictive model for mold inhibition in baked goods, as well as improvements to the Corbion Listeria Control Model that more accurately mimic the effects of changing storage temperatures.

In Functional Systems, we combine applied science and experienced technical support to provide customers with novel blends that help them respond quickly to business and market challenges such as cost volatility, functionality issues, nutritional preferences (such as keto and salt/sugar reduction), and raw material scarcity. Manufacturers turn to us for deep application understanding and advanced blending capabilities to solve problems through dough conditioning and shelf-life solutions for the bakery industry, as well as for our blending proficiencies and sophisticated expertise in shelf life, texture improvement, and stabilization technologies for the dairy market.

In January 2024, Corbion and Kingswood Capital Management reached an agreement regarding the strategic divestiture of Corbion's Emulsifier business. The divestment aligns with our Advance 2025 strategy to further strengthen core competencies built around our advanced fermentation expertise.

Lactic Acid & Specialties

Lactic Acid & Specialties encompasses Biochemicals (lactic acid, salts, esters, and other specialties), Biomaterials (polymers for medical and pharmaceutical applications), and TotalEnergies Corbion (our joint venture with TotalEnergies for the production and marketing of Luminy® PLA).

In Biochemicals, we enable brand owners to commercialize safe performance products using our lactic acid-based products and technology. Corbion leads the global lactic acid market in technology, production, scale and breadth of portfolio, and geographic coverage. We fuel our customers’ success by creating specialties for many markets and applications, and tuning the functionality of our products to specific customer requirements.

To further strengthen our position in attractive growth markets, by the end of 2023, we mechanically completed the first-of-its-kind new circular lactic acid plant at our existing site in Rayong Province, Thailand. The plant, with a production capacity of 125,000 metric tons of lactic acid annually, will be operational in 2024. Lactic acid produced by this facility will have the lowest associated carbon footprint compared to any manufacturing technologies currently used. The recycling of processing chemicals eliminates the use of lime and the formation of gypsum as a by-product. This novel method will be more cost-effective compared to conventional schemes and demonstrates our commitment to meeting the evolving needs of our customers, shareholders, and the planet.

In Biomaterials, we contribute to the creation of a more sustainable and accessible healthcare system. We work with leading medical and pharmaceutical players on advancements in cardiovascular devices, orthopedic implants, tissue regeneration scaffolds, wound management, and novel drug delivery systems. Our strategy leveraging safe and resorbable polymers aligns well with current trends and opportunities in the healthcare sector.

TotalEnergies Corbion

TotalEnergies Corbion is our 50/50 joint venture with TotalEnergies for the production and marketing of Luminy® PLA. Via this business, Corbion captures further value from our leading lactic acid platform and secure a key role in the development of new, safe, and sustainable polymers for the materials market.

Following a thorough review of the investment case, Corbion announced in June of 2023 that we would not proceed with the construction of a new PLA bioplastics plant in Grandpuits, France, through our TotalEnergies Corbion joint venture. This decision underscores our commitment to disciplined capital allocation.

Algae Ingredients

Our Algae Ingredients business unit produces algae-based ingredients that deliver high levels of essential nutrients in human and animal diets, such as long-chain omega-3 fatty acids (omega-3).

With our omega-3 platform, we will keep expanding our sustainable nutrition offerings beyond aquaculture, where we currently use omega-3 DHA to help producers and stakeholders develop more sustainable feed for salmon, shrimp, and other species by de-bottlenecking this essential nutrient supply, given that oceans will not be able to provide sufficient omega-3 without adverse impacts. We expect significant development potential for omega-3.

The AlgaPrime™ DHA portfolio for pet food is advancing sustainability and health for companion animals and creating opportunities to deliver enhanced value for the industry. In addition, we will keep exploring ways to use our AlgaVia™ line of algae oils for human nutrition to expand our impact on human diets.

Meanwhile, we remain dedicated to investing in initiatives with a longer time horizon. We are developing an Algae Ingredients roadmap for 2025 to 2030 that aligns with strong growth prospects. Internal efforts are underway to develop new algae-based solutions that leverage our innovation platform, applications, and industry knowledge.

Incubator

In our Incubator, where we develop early-stage initiatives, we are working on five selected programs: Algae Portfolio Extension, Biopolymers, Natural Preservation, Circular Raw Materials, and Net Zero. Each of these long-term platforms is linked to a Corbion business unit and embedded in its innovation programs.

Research and development (R&D) initiatives

Succeeding in a rapidly changing world requires agility, strong collaborative networks, and (open) innovation. Increasingly, businesses rely on partners and suppliers in the value chain for innovation, R&D services, and scientific evidence to back functionality claims. Broader awareness of the burdens we place on our planet has also fueled the demand for science-based solutions that reduce the environmental impact of manufacturing and use of products.

The trend toward collaborative innovation and the need for evidence of functionality and sustainability provide opportunities for Corbion. As a result, we have refocused in-house R&D to support accelerated execution of Advance 2025 and the pursuit of new opportunities via innovation partnerships, several of which have been identified in the six focus areas of Advance 2025.

Our strategy for 2020–2025 projects calls for an R&D spend of approximately 4% of net sales.

Investments over strategy period

Having established a leading global position in lactic acid and lactic acid derivatives, maintaining our differentiated position is a strategic imperative. The demand for lactic acid has led to investments in the expansion of several of our existing lactic acid facilities and the construction of a new, first-of-its-kind lactic acid plant in Thailand, leveraging our innovative circular production technology. These investments also support the realization of our Climate Transition Action Plan. Growing our Algae Ingredients business requires further investment as we continue to improve existing products and develop new ones. Further technology investments will enhance our readiness to use next-generation feedstocks such as second-generation sugars from agricultural residues as they become available through our partners. Strengthening our capabilities will help drive key strategic initiatives, including the ongoing development and implementation of our Solutions Model in existing and adjacent markets within the food sector. Next to this, we are committed to delivering on our initiatives in medical biomaterials and biochemicals. During the strategic period, a substantial multi-year investment has been underway as we implement a new Enterprise Resource Planning platform (SAP S/4HANA), which is slated for completion in 2024. In concert with various excellence programs, this initiative will help drive progress toward our strategic objectives.

Targets Advance 2025

Sustainable development targets

2025 1 | 2030 1 | |

Preserving what matters | ||

Net sales contributing to the SDGs (SDG 2, 3, 12, 13, 14)2 | > 75% | > 85% |

Preserving food and food production | ||

Verified responsibly sourced cane sugar3 | 100% | 100% |

Verified deforestation-free key agricultural raw materials4 | 100% | 100% |

Preserving health | ||

Total Recordable Injury Rate5 | < 0.5 | < 0.25 |

Preserving the planet | ||

Renewable electricity | 100% | 100% |

Scope I & II emissions reduction (SBTi-approved target)6 | n/a | 38% |

Scope III emissions reduction (SBTi-approved target)7 | n/a | 24% |

Recycling of by-products8 | 100% | 100% |

Landfill of waste | n/a | 0 kT |

Measuring what matters | ||

Products covered by Social Value Assessment9 | 100% | 100% |

Fermentation-derived products covered by Life Cycle Assessment10 | 100% | 100% |

- 1 Targets based on current manufacturing footprint; to be reviewed in case of acquisitions/major changes.

- 2 Net sales of products for which there is evidence that the product contributes to the SDGs. See our Measuring what matters whitepaper for more details.

- 3 Bonsucro-certified or meeting the requirements of Corbion’s Cane Sugar Code verified by third-party audits, by quantity, for sugar used for fermentation. See our Cane Sugar Policy for more information. The scope of this target was adjusted in 2023. More information can be found in the section on Responsible sourcing / cane sugar.

- 4 Key agricultural raw materials include cane sugar for fermentation, dextrose derived from corn, palm oil and derivatives, soy-bean oil and derivatives, and wheat, by quantity. Through Bonsucro certification, RSPO certification, or other certification covering deforestation; or demonstrated to be deforestation-free based on satellite data, third-party audits (e.g., Corbion Cane Sugar Code audit), and/or country-of-origin statements.

- 5 Based on OSHA guidelines; including contractors.

- 6 Scope I emissions from direct production (from fuels), Scope II emissions from purchased energy (electricity and purchased steam, market-based). Absolute reduction compared to 2021 as the base year.

- 7 Scope III emissions related to key raw materials, waste, and transport, per ton of product. Progress is reported compared to 2021 as the base year.

- 8 By quantity.

- 9 The Social Value Assessment is done according to the methodology described in the Handbook for Product Social Impact Assessment, published by the Social Value Initiative and applies to products manufactured at Corbion sites (cradle-to-gate). Outsourcing is excluded. By quantity.

- 10 The Life Cycle Assessment is peer reviewed according to the ISO 14040/44 standards for Corbion’s core products (such as lactic acid) or done according to the “LCA Approach for Corbion’s Product Portfolio: Lactic acid derivative plants, Corbion 2017,” which has been externally reviewed against and is considered to be in line with the principles of the ISO 14040/44 standards. Applies to fermentation-derived products manufactured at Corbion sites (cradle-to-gate). Outsourcing is excluded. By quantity. The scope of this target was adjusted in 2023. More information can be found in the section on Life Cycle Assessment.

Financial guidance

During our Capital Markets Day in December 2022, we presented an update of our financial targets.

Our Advance 2025 strategy aims to deliver organic net sales growth in the 2023–2025 growth period of between 5 and 8 percent annually for Corbion’s core activities.

Financial targets | CMD 2020 | CMD 2022 (2023-2025 targets) | |

Core | Organic net sales growth1 | 4 - 7% p.a. | 5 - 8% p.a. |

Core | Organic adjusted EBITDA growth | - | 15 - 20% p.a. |

Underlying ambitions | |||

Sustainable Food Solutions | Organic sales growth1 | ~3% | ~5% |

Lactic Acid & Specialties | Organic sales growth1 | ~7% | ~7% |

Algae Ingredients | Organic sales growth1 | - | ~25% |

Incubator: Omega-3 | Adjusted EBITDA | Breakeven by 2022 | - |

Incubator: other | Adjusted EBITDA investment | 0.5 - 1.5% of Corbion core sales | 0.5 - 1.5% of Corbion core sales |

Core | Adjusted EBITDA margin | >17% from 2025 | >17% from 2025 |

Corbion | Capex | € 115M - 125M avg. p.a. | € 160M avg. p.a. |

Corbion | Covenant net debt/covenant EBITDA | ~2.0x; peak at 2.5x | 1.5-2.5x |

Corbion | ROCE | >WACC | > WACC |

- 1 Organic growth defined as volume growth + mix growth, excluding price impact